Foreign direct investment in Korea explained

Types of business entities that foreigners can establish in Korea

How can foreigners run a business in Korea? Depending on your goals, you can choose from the following four options.

First, you can establish a local corporation or invest in an existing one. To qualify as a ‘foreign investment’ under the Foreign Investment Promotion Act, which provides certain incentives such as lower corporate tax rates and subsidies, your investment must be at least KRW 100 million and you must acquire 10% or more of the stocks with voting rights.

Second, if you’re an individual, you could open a private business as a sole proprietor.

Third, if you’re a foreign company, you could establish a Korean branch. The difference between a ‘branch’ and a ‘local corporation’ is that a branch is not entitled to the incentives under the Foreign Investment Promotion Act.

Fourth, you could set up a liaison office. A liaison office can only carry out non-sales functions such as business contacts and market research so if you’re willing to carry out business activities in Korea, this is not the right option for you.

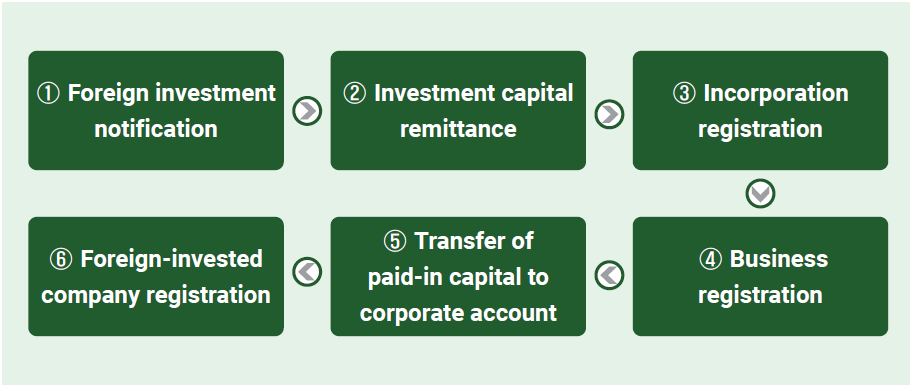

Establishing a local corporation

If your goal is to generate profits and benefit from the Foreign Investment Promotion Act, you should establish a local corporation.

There are four key steps. If you’re investing in an already established company, you may skip steps (2) and (3).

(1) file a foreign investment notification at a commercial bank in Korea;

(2) incorporate the local corporation and register it at the court registry;

(3) register the local corporation’s business at the local tax office;

(4) register the local corporation as a foreign-invested company at the aforementioned bank.

(1) Foreign investment notification

The first thing you should do is file a ‘foreign investment notification’.

You must fill out this form and submit it at either the Korea Trade-Investment Promotion Agency (KOTRA) or a local bank in Korea.

I would recommend filing the notification through a local bank. You’ll need to work with one anyway to handle the capital remittance, and it’s much smoother if the bank is already familiar with the transaction.

One common question I get from clients is whether they can use a Korean branch of a foreign bank such as SMBC, CCB, or Deutsche Bank. While that’s possible, you should first confirm that the bank is authorized in Korea to handle foreign exchange transactions for FDI. Still, I usually recommend using one of the major Korean commercial banks, as they process these transactions routinely and can minimize potential delays.

(2) Incorporation registration

After you have succesfully remitted the investment capital to a local bank, the next step is incorporation registration.

When registering a newly incorporated company, foreign applicants must visit the court registry in person and submit the following documents.

Application form

Articles of incorporation

Minutes of the inaugural general meeting

Written consent to matters concerning issuance of shares

Documents certifying subscription to shares

Inspection report

Securities subscription deposit certificate or certificate of balance

(If the foreign investor is a company) Certificate of incorporation and passport copy of the representative director (both documents must be notarized and apostilled)

(If the foreign investor is an individual) Passport copy (must be notarized and apostilled)

Report of seal

Acceptance of office

(If the initial director or auditor is a foreigner) Certificate of address and passport copy (both documents must be notarized and apostilled)

Receipt of payment of registration tax and application fee

(3) Business registration

While the incorporation registration only requires the local corporation’s address, the business registration requires the submission of a lease agreement copy. Therefore, you must finalize your lease before applying for business registration.

If the office is sub-leased, make sure to check whether the original lease allows sub-leasing. If not, you must also obtain a consent letter from the landlord.

(4) Foreign-invested company registration

Upon completion of business registration, the local corporation becomes a legal entity and the paid-in capital deposited in a temporary account can now be transferred to a corporate account.

The final step is to register the local corporation as a ‘foreign-invested company’ by filling out this form.

After the registration is complete, you or a representative of the company may apply for a D-8 visa.

If you want to learn more, this guideline published by the Korean government will be helpful.